Dairy export to China is significantly impacted by the intensifying U.S.–China trade conflict, extending its effects beyond politics and tariffs to the global dairy industry. With China being one of the world’s largest dairy importers, any shift in trade dynamics directly influences suppliers, pricing, and global competition. The latest round of tariffs has dramatically reshaped sourcing strategies for Chinese dairy buyers, opening new doors for alternative exporters.

Dairy Export to China and the Fallout from U.S. Tariffs

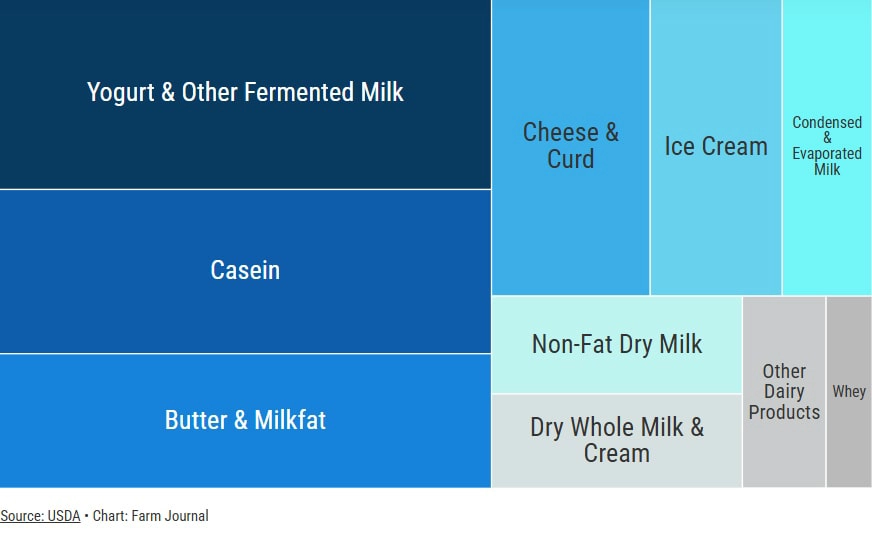

Dairy export to china, in recent years, has grown steadily, driven by rapid urbanization, rising incomes, and the expansion of its middle class. This increasing domestic consumption has outpaced local production, creating a widening gap that must be filled by imports. Historically, the United States has been a key supplier to the Chinese market, particularly for specialized dairy ingredients such as whey powder, lactose, and permeate. These products are critical inputs for several high-value industries in China, including infant formula manufacturing, baked goods production, and animal feed formulations.

However, escalating trade tensions between the United States and China disrupted this trade dynamic. In response to the U.S. imposing higher tariffs on Chinese goods—reportedly increasing tariff rates from 34% to 84%—China implemented retaliatory measures by sharply raising import duties on U.S. dairy products, with tariffs reportedly reaching as high as 125%. This steep increase in import costs has significantly reduced the competitiveness of U.S. dairy exports in the Chinese market. As a result, many American dairy exporters have been effectively priced out, leading to a noticeable decline in U.S. dairy shipments to China. Consequently, Chinese buyers have been compelled to seek alternative suppliers, turning to other exporting countries to meet China’s dairy demand.

Respond to China’s Dairy Demand

With U.S. dairy exporters facing a competitive disadvantage due to elevated Chinese tariffs, suppliers from Europe, New Zealand, and the United Kingdom have swiftly moved to fill the gap in the Chinese market. These regions have seized the opportunity to increase their market share, offering Chinese buyers alternative sources of high-quality dairy products. New Zealand, in particular, has leveraged its free trade agreement with China, enabling tariff-free access for its dairy exports. This preferential trade status provides New Zealand exporters with a significant pricing advantage over competitors from tariff-affected regions.

European Union countries have also strengthened their position by focusing on delivering consistently high product quality, meeting China’s stringent import and food safety regulations, and maintaining reliable supply chains. The United Kingdom, despite navigating post-Brexit trade adjustments, has pursued increased exports to China through targeted trade initiatives and regulatory alignment efforts.

As a result, Chinese importers are increasingly sourcing from suppliers who can offer competitive pricing, stable supply, and proven compliance with China’s import requirements—while remaining insulated from the geopolitical risks affecting U.S. trade. This shift highlights a growing preference for partners who can deliver both economic and operational reliability in a complex global trade environment.

Dairy Ingredients Suppliers to China and Global Supply Chain Adjustments

The U.S. dairy industry is currently navigating the challenges of a significant oversupply of key dairy ingredients, including whey powder and lactose. As exports to major markets like China have declined—due in large part to retaliatory tariffs and shifting trade policies—domestic inventories have surged. This surplus has exerted downward pressure on domestic prices, squeezing margins for producers, processors, and exporters across the value chain.

For leading businesses in the sector, this environment has intensified the need to diversify export markets and reduce reliance on any single trading partner. Companies are responding by pursuing new sales channels in emerging markets, establishing trade partnerships in regions with more favorable trade conditions, and developing higher-value dairy products to buffer against commodity price volatility. Exporters are also prioritizing agility and adaptability, seeking to realign supply chains, enhance product innovation, and strengthen risk management strategies in response to global trade disruptions.

This shift reflects a broader trend within the U.S. dairy sector: top-performing businesses are those actively investing in market diversification, product innovation, and supply chain resilience to maintain competitiveness in an increasingly complex and unpredictable global trade environment. Also, to further enhance your online presence and effectively reach global markets, check out opportunities like AAMAX.

Hiroland: Licensed and Ready for Dairy Exports to China

Amid the evolving global dairy trade landscape and ongoing U.S.–China trade tensions, Hiroland proudly holds an official export license for dairy ingredients to China—an achievement that underscores our commitment to product quality, food safety, and regulatory compliance. This export license positions Hiroland as a trusted, tariff-efficient supplier for Chinese buyers navigating the challenges of the current trade environment.

With China’s growing demand for essential dairy ingredients like whey powder, lactose, and permeate—used in infant formula, bakery, and animal feed industries—Hiroland offers a reliable range of dairy ingredients, milk powders, dairy fats and butter to suppliers affected by tariff hikes. Our licensed status ensures smooth customs clearance and compliance with China’s stringent import regulations, giving Chinese importers confidence in both supply continuity and safety standards.

As global dairy supply chains adjust to the impact of tariffs and shifting market dynamics, Hiroland stands ready to deliver consistent, high-quality dairy exports to China. We are committed to supporting Chinese manufacturers and food producers with stable ingredient supply, competitive pricing, and minimized geopolitical risk. By partnering with Hiroland, Chinese buyers gain access to a dependable, future-ready source of dairy ingredients in an increasingly complex global dairy market.

Please reach out to us today to get detailed pricing information.

Read More: Hiroland’s Global Reach: Supplying Premium Dairy Ingredients Worldwide

Read More: Trade Turbulence Could Shake Up Dairy Exports to China